Introduction

Introduction

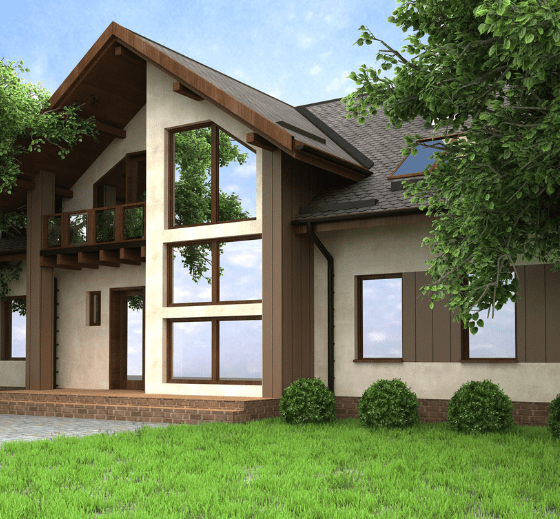

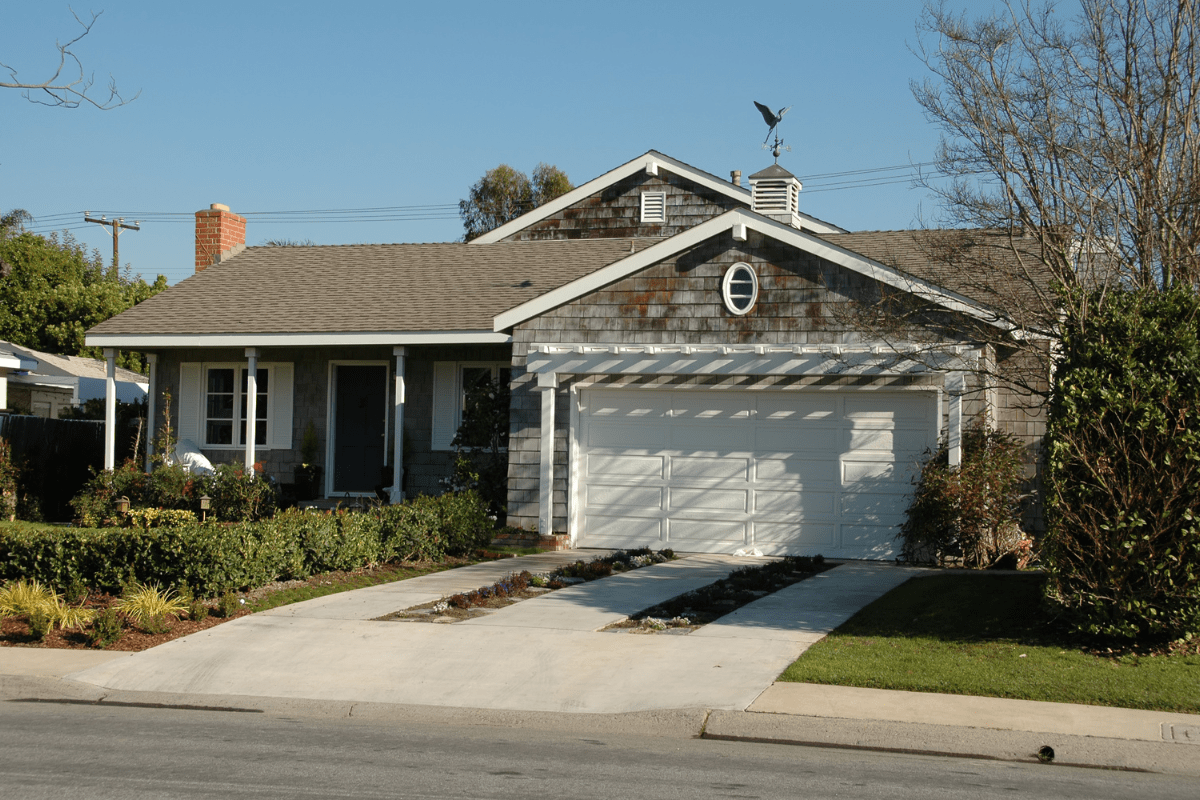

Buying a home is a big decision – particularly your first home – but it is one of the best choices anyone can make. It’s a place that is entirely your own. Something you can paint, renovate, and live a full life in. Secondly,the reality is that homes are an incredible way to accumulate generational wealth. Because home isn’t only where your heart is, it’s where your money is, too. There are few places you will treasure more than your home and no place that will add more to your personal treasury. ”While the prospect of home ownership is exciting, it can also be filled with complexities as you embark on the journey for the very first time. Below you’ll find part one of a complete guide to first-time home buying.

Buying your first home is a great decision. It's a place where you can live a full life, and it's also an excellent way to accumulate generational wealth. However, the process can be complex. To help you navigate this journey, we've put together a complete guide to first-time home buying.

Finding Your Agent

Finding Your Agent

The legal, financing, and regulatory aspects of real estate transactions are very involved. To provide as much protection as possible for you, it’s wise to find a licensed real estate agent. They will serve as an advocate for you and your interests throughout the entirety of the home buying process. Their job is about much more than simply finding you the right home; it’s about listening to your needs, anticipating problems, and maintaining standards.The main duties of your real estate agent include: Educating you about your market. Analyzing your wants and needs. Guiding you to homes that fit your criteria. Coordinating the work of other needed professionals. Negotiating on your behalf. Checking and double-checking paperwork and deadlines. Solving any problems that may arise.Here are a couple of questions to ask as you look for a real estate agent: Why did you become a real estate agent? Why should I work with you? What process will you use to help me find the right home for my wants and needs? Because ome isn’t only where your heart is, it’s where your money is, too. There are few places you will treasure more than your home and no place that will add more to your personal treasury.

Part Two: Your First-Time Homebuyer’s Guide Identifying Your Criteria

Part Two: Your First-Time Homebuyer’s Guide Identifying Your Criteria

In the homebuying process, an initial consultation with your agent is your way to make sure you are prepared. You may think you already have a pretty good idea of what your first home might look like, and you’re probably right. However, you want to be sure you haven’t missed something. That’s why it’s important to sit down, talk through things with your agent. Your agent will help you get to the heart of what you want, why you want it and establish search criteria around what you truly need.

Recognize the right home will meet all your needs and as many of your “wants” as possible.

An initial consultation with your agent is crucial when buying a home. Discuss your vision with your agent to ensure you haven't missed anything. Your agent will help establish search criteria. The perfect home should meet all your needs and as many wants as possible.

As you and your agent work to establish your criteria, some questions you should ask yourself may include:

● What do I want my home to be close to?

● What do I want my neighborhood to be like?

● How much space do I need?

● Would I be interested in a fixer-upper?

● What features do I need?

● What amenities do I want?

● What does my home have to have now?

● Of all my wants and needs, which are the most important